The Zacks Retail and Wholesale Sector has struggled year-to-date amid a challenging macroeconomic backdrop, down nearly 20% and underperforming the general market by a wide margin. However, the sector has marginally outpaced the S&P 500 over the last month.

A widely-popular company residing in the sector, Big Lots , is on deck to unveil Q2 earnings on Tuesday, August 30th, before market open.

Big Lots is a broad-line closeout retailer in the United States with various merchandising categories, including food, consumables, furniture, seasonal, soft home, hard home, electronics, and toys.

Currently, the company is a Zacks Rank #3 (Hold) with an overall VGM Score of a D. How does everything stack up for the retailer heading into the quarterly print? Let’s take a closer look.

Share Performance & Valuation

It’s been a harsh road for Big Lots shares in 2022, losing more than half of their value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

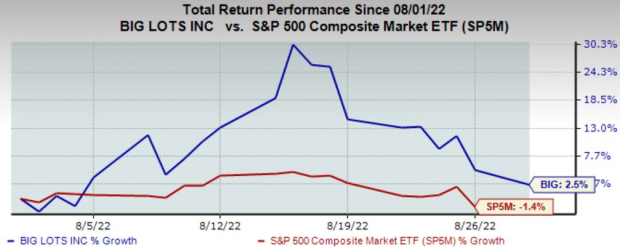

However, over the last month, the tide has changed – BIG shares have tacked on 2.5% in value, outperforming the S&P 500’s decline of 1.4%.

Image Source: Zacks Investment Research

The company’s forward price-to-sales ratio resides at 0.1X, nicely below its five-year median of 0.3X and representing a steep 92% discount relative to its Zacks Retail and Wholesale Sector.

In addition, Big Lots carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

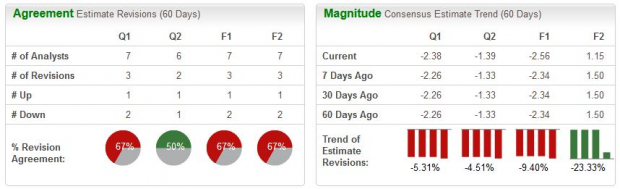

Analysts have been primarily bearish in their earnings outlook, with two negative estimate revisions hitting the tape over the last 60 days. The Zacks Consensus EPS Estimate of -$2.38 reflects a steep 320% drop-off in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

Quarterly revenue estimates allude to a weakening top-line as well – Big Lots is forecasted to have generated $1.4 billion in quarterly revenue, penciling in a 7% year-over-year drop.

Quarterly Performance & Market Reactions

BIG’s bottom-line results have primarily been mixed, with just five EPS beats over its last ten quarters. Just in its latest print, the company registered a steep 143% bottom-line miss.

However, top-line results have been much more robust – Big Lots has exceeded revenue estimates in seven of its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has had mixed reactions in response to BIG’s quarterly reports, with shares moving up three times upwards and three times downward following the last six prints.

Putting Everything Together

BIG shares have tumbled in 2022 but have posted market-beating returns over the last month, signaling buyers have finally started nibbling.

Shares trade at solid valuation levels, with its forward P/S ratio residing nicely below its five-year median and Zacks Sector average.

Analysts have been primarily bearish in their earnings outlook, and estimates reflect decreases in earnings and revenue.

BIG’s bottom-line results have left some to be desired, but quarterly revenue has consistently exceeded expectations.

Heading into the release, Big Lots carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -3.2%.

Image: Shutterstock

Big Lots Q2 Preview: Can Shares Find New Life?

The Zacks Retail and Wholesale Sector has struggled year-to-date amid a challenging macroeconomic backdrop, down nearly 20% and underperforming the general market by a wide margin. However, the sector has marginally outpaced the S&P 500 over the last month.

A widely-popular company residing in the sector, Big Lots , is on deck to unveil Q2 earnings on Tuesday, August 30th, before market open.

Big Lots is a broad-line closeout retailer in the United States with various merchandising categories, including food, consumables, furniture, seasonal, soft home, hard home, electronics, and toys.

Currently, the company is a Zacks Rank #3 (Hold) with an overall VGM Score of a D. How does everything stack up for the retailer heading into the quarterly print? Let’s take a closer look.

Share Performance & Valuation

It’s been a harsh road for Big Lots shares in 2022, losing more than half of their value and extensively underperforming the S&P 500.

Image Source: Zacks Investment Research

However, over the last month, the tide has changed – BIG shares have tacked on 2.5% in value, outperforming the S&P 500’s decline of 1.4%.

Image Source: Zacks Investment Research

The company’s forward price-to-sales ratio resides at 0.1X, nicely below its five-year median of 0.3X and representing a steep 92% discount relative to its Zacks Retail and Wholesale Sector.

In addition, Big Lots carries a Style Score of a B for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been primarily bearish in their earnings outlook, with two negative estimate revisions hitting the tape over the last 60 days. The Zacks Consensus EPS Estimate of -$2.38 reflects a steep 320% drop-off in quarterly earnings Y/Y.

Image Source: Zacks Investment Research

Quarterly revenue estimates allude to a weakening top-line as well – Big Lots is forecasted to have generated $1.4 billion in quarterly revenue, penciling in a 7% year-over-year drop.

Quarterly Performance & Market Reactions

BIG’s bottom-line results have primarily been mixed, with just five EPS beats over its last ten quarters. Just in its latest print, the company registered a steep 143% bottom-line miss.

However, top-line results have been much more robust – Big Lots has exceeded revenue estimates in seven of its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has had mixed reactions in response to BIG’s quarterly reports, with shares moving up three times upwards and three times downward following the last six prints.

Putting Everything Together

BIG shares have tumbled in 2022 but have posted market-beating returns over the last month, signaling buyers have finally started nibbling.

Shares trade at solid valuation levels, with its forward P/S ratio residing nicely below its five-year median and Zacks Sector average.

Analysts have been primarily bearish in their earnings outlook, and estimates reflect decreases in earnings and revenue.

BIG’s bottom-line results have left some to be desired, but quarterly revenue has consistently exceeded expectations.

Heading into the release, Big Lots carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -3.2%.